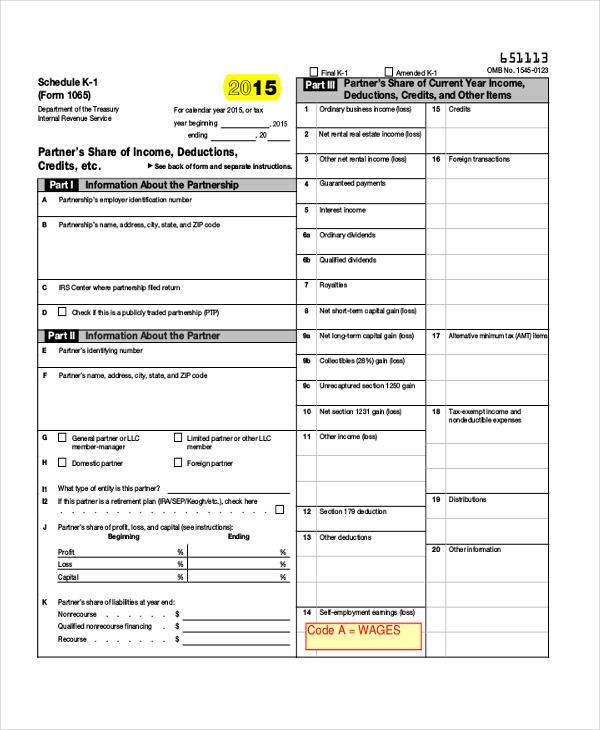

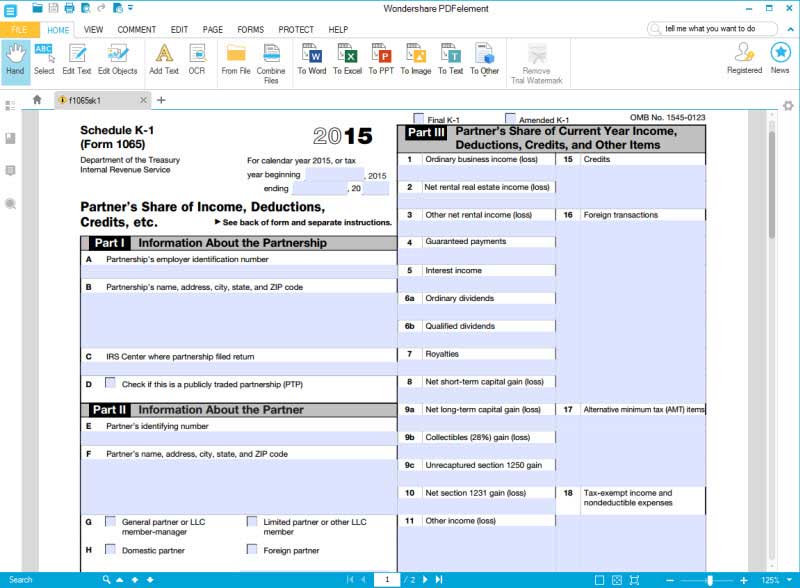

Schedule K-1 of Form 1120S, which must be filed by the owners of S corporationsĪlthough these forms are similar, in this guide we’ll focus exclusively on Schedule K-1 of Form 1065, to be filed by partnerships.Schedule K-1 of Form 1041, which must be filed by beneficiaries of trusts or estates.There are actually two additional forms that the IRS calls ‘Schedule K-1’: (That is, it hasn’t filed Form 8832 or Form 2553.) Your company is an LLC with multiple owners and has not decided to be taxed as a C or S corporation.You’ve signed a partnership agreement and registered the partnership with the state.

(Remember: you don’t need to file any forms with your state to start a partnership. You co-own a business with one or more other person, but that business isn’t incorporated.Not sure whether you’re in a partnership? Here are some telltale signs: Report the items on your individual Schedule K-1 at the appropriate places on your tax return. Make sure your partnership has filed a Partnership Tax Return, Tax Form 1065 and issued K-1s to all of the partners You need to do at least two things during tax season: If you’re a partner in a partnership that is required to file a tax return for the year, then you will receive a K-1 that lists your portion of the partnership reportable items.

0 kommentar(er)

0 kommentar(er)